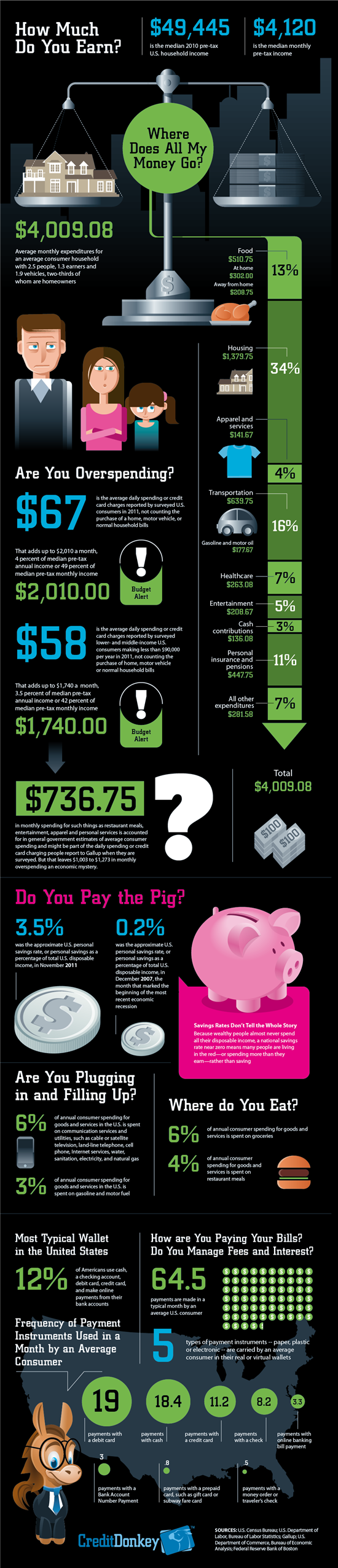

"This feature tracks the performance of stocks Barron's has written about -- both favorably and critically. For stocks featured in Barron's print magazine, prices are measured from the Friday before publication date to their current price. For stocks featured on Barrons.com, prices are measured from the trading day of publication date to their current price. This list includes U.S. stocks only, including ADRs, but not foreign stocks."On some occasions I have found these picks also include ETFs. However, what I found interesting when browsing this list is the ratio of bullish picks to bearish picks. Both the magazine and online feature much more bullish picks than bearish picks, and I guess that makes sense...people in general like to hear about opportunities rather than risks (and their average reader probably doesn't short to a great degree). But the most interesting thing was how much more bullish Barron's was online than in print.

As you can see in the chart below, in Barron's magazine they wrote about 4 stocks favorably for every 1 stock they wrote about critically. However, online that ratio jumped up to 7.5 to 1.

Since 2007, Barron's documented 718 stocks which they wrote about in their magazine either "favorably" or "critically" (they categorize them as bullish or bearish). Only 144 were "bearish". Meanwhile,they documented a total of 782 stocks online.....but only 92 of those were "bearish". You can see below how this disparity has grown over the last 3 years (only in 2009 was the magazine more bullish than online). Of the 42 online picks since 2011...only 2 were "bearish" and there have been none this year.

Barron's is often bullish with it's stock picks -- especially online. However, it's track record would indicate that it is only their bearish picks -- and ONLY those featured in their magazine which tend to more consistently pan out. That is completely the opposite of their bearish picks online -- those stocks you would usually be better of buying (note that in 2011 they only made 2 bearish picks online and while they were correct on Japan they got killed on Monster "MNST")

Interestingly, this same general pattern holds shorter-term. Barron's also measures the performance of the picks from the time of the pick until the end of the year in which they made the pick. For instance, if it was picked today it would measure it's performance until 12/31/12. So some picks are being measured up to a year and some possibly as short as a few days.

So both short and long-term the story appears to be that Barron's bullish picks are a coin toss (or worse), while their critical thoughts on stocks in the magazine might be worth heeding, whereas their critical thoughts expressed online might well be a contrarian indicator! So I guess the question is why the huge difference in their bearish picks online vs the magazine?