Gotta love it! So on the one hand their analyst is saying 'Buy" because with a price target of $135 it is 17% undervalued. Then your later being told that, by the way, our "proprietary quantitative model" says you should lose about 42% listening to that Analyst.

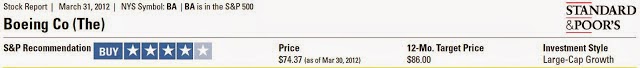

This isn't some one-off thing, in fact, it is amazingly common. How about Boeing? Looks like another buy! Price Target $86. Not a bad 16% gain.

Oh wait......

Sorry, S&P actually says you should lose 27%.

Don't worry, your not the only person wondering why something has a "Hold" rating when it's price target is 11% lower. However, to the analysts credit the "hold" rating was put on when it was trading at $378 (but don't give too much credit -- why is he recommending to hold something he thinks should go down in price?)

Worse yet, not only does the analyst think it's overvalued but so does S&P's "fair value calculation". By 30% in fact. Yet still no "Sell" rating?

I think you get my point......These "Price Target's" are pure humor. And as you may have guessed, the corresponding star ratings provide nothing useful in performance -- and actually have detracted as you can see in the below performance of their "All Stars" basket of stocks vs the regular S&P 500.