I thought it would be interesting to run this test on some well known financial bloggers......

I fed Josh's recent post "The Biggest Threat To You Portfolio" into the service and this is what IBM's Watson had to say.

"You are inner-directed and skeptical.You are empathetic: you feel what others feel and are compassionate towards them. You are calm-seeking: you prefer activities that are quiet, calm, and safe. And you are independent: you have a strong desire to have time to yourself.Your choices are driven by a desire for belongingness.You are relatively unconcerned with tradition: you care more about making your own path than following what others have done. You consider helping others to guide a large part of what you do: you think it is important to take care of the people around you."

For Barry I fed in his recent post (Protect Your Assets: Common-sense CyberSecurity for Investors) and Watson says....

"You are shrewd and somewhat insensitive.

You are proud: you hold yourself in high regard, satisfied with who you are. You are confident: you are hard to embarrass and are self-confident most of the time. And you are assertive: you tend to speak up and take charge of situations, and you are comfortable leading groups.

Your choices are driven by a desire for prestige.

You are relatively unconcerned with tradition: you care more about making your own path than following what others have done. You consider helping others to guide a large part of what you do: you think it is important to take care of the people around you."

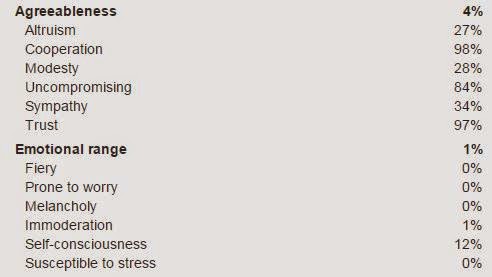

Here I plugged in Bill's text from this post. This is Watson's feedback.....

"You are inner-directed, heartfelt and rational.

You are imaginative: you have a wild imagination. You are philosophical: you are open to and intrigued by new ideas and love to explore them. And you are deliberate: you carefully think through decisions before making them.

Your choices are driven by a desire for organization.

You are relatively unconcerned with helping others: you think people can handle their own business without interference. You consider tradition to guide a large part of what you do: you highly respect the groups you belong to and follow their guidance."

Side Note: Wow did that really just say 0% for extraversion? Can't get more introverted then that. While I have not met Bill, considering his blog, why do I not find that surprising?

I used his most recent most and it appears Watson confirms his Philosophical nature....

"You are inner-directed, skeptical and can be perceived as insensitive.

You are philosophical: you are open to and intrigued by new ideas and love to explore them. You are independent: you have a strong desire to have time to yourself. And you are unconcerned with art: you are less concerned with artistic or creative activities than most people who participated in our surveys.

Your choices are driven by a desire for discovery.

You are relatively unconcerned with both taking pleasure in life and helping others. You prefer activities with a purpose greater than just personal enjoyment. And you think people can handle their own business without interference."

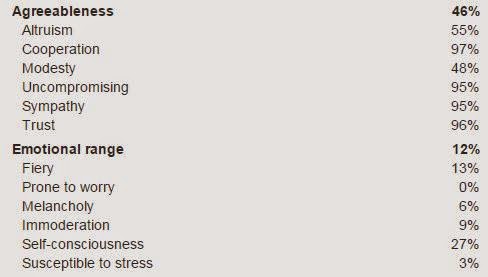

So what does Watson say about me? I used my last post to find out....

"You are inner-directed, heartfelt and rational.

You are self-assured: you tend to feel calm and self-assured. You are calm-seeking: you prefer activities that are quiet, calm, and safe. And you are dispassionate: you do not frequently think about or openly express your emotions.

Your choices are driven by a desire for discovery.

You are relatively unconcerned with helping others: you think people can handle their own business without interference. You consider achieving success to guide a large part of what you do: you seek out opportunities to improve yourself and demonstrate that you are a capable person."

Interesting to see all the bloggers I put in (except for Barry) were said to be "Inner-Directed" first and foremost. Check out yourself or someone else here https://watson-pi-demo.mybluemix.net/